The construction sector looks set for a bumpy ride in 2024, as the economy teeters on the brink of a recession. However, continuing skills shortages and the drive for decarbonisation mean buildings services engineers are in high demand.

Across the industry, firms are bullish, with 82% of employers intending to take on staff in the next 12 months. One major building services engineer is looking at a 5% increase in headcount.

According to the annual industry salary survey carried out by recruitment consultancy Hays for CIBSE Journal, more than half (54%) of construction and property employers cite the economic climate as their main external challenge over the next 12 months. Feedback from contractors is that this year looks a ‘bit tougher’, says Tomás Neeson, managing partner at Cundall.

The downturn in the commercial and residential markets, compounded by uncertainties surrounding implementation of the government’s Building Safety Act and the looming general election, mean things are ‘slowing down a bit’, says John Lewis, head of building engineering for UK & Ireland at Aecom. However, he is ‘cautiously optimistic’ about growth.

While sensing a ‘tiny bit of nervousness’ about prospects for later this year, Ben Styles, a senior business director at Hays, says the offices he visits remain ‘really, really busy’. ‘Their order books and workflow have not dropped off,’ he adds.

Alex Hill, managing director of Whitecode, says the Kent-based engineer is still receiving ‘strong’ levels of inquiries and orders.

Any nerves about growth are not showing up in firms’ hiring intentions. That 82% of employers across construction and property intend to take on staff over the coming 12 months shows no change on last year’s survey results.

The same seems to be true in building services, judging by CIBSE Journal’s straw poll of leading firms in the sector. Lewis, at Aecom, says he is projecting a headcount increase of around 5%, while Cundall has a target to recruit 62 graduates over the next year, without taking into account other avenues, such as apprenticeship schemes.

Alex Hill, Whitecode

The buoyancy of building services engineering is partly explained by the fact that construction sectors that have been worst hit by the economic situation, such as volume housebuilding, have relatively little call for the discipline’s skills.

The impact of any downturn is also likely to be mitigated by ongoing skills shortages across the industry. Hays reports that the proportion of construction employers reporting shortages over the past 12 months is down, but only slightly, at 93% compared with 95% in last year’s survey.

The impact of these shortages on firms is increasing, with 47% saying skills shortages have affected their ability to deliver projects, up from 40% last year.

There’s a ‘big shortage’ of engineers with a couple of years’ experience, says Styles. However, competition is greatest for mid-level grades, typically engineers with 10 to 15 years’ experience, partly because of people taking up opportunities overseas or returning to their home countries.

Phil Jackson, Hays’ construction director for UK and Ireland, says: ‘There is a desire by companies to hold onto their staff rather than having to let people go.’ This means opportunities for those who do lose their jobs, he adds. ‘I don’t know anybody who’s been on the market very long. If they’ve been made redundant, somebody’s taking them on because they’re seeing an opportunity to snap up a good person.’

Building services is also benefiting from the wider push to decarbonise the built environment, according to Styles. ‘Sustainability and energy management are in the headlines, and the driving force of that is building services. Heat pumps, new boiler systems and new lighting schemes have all got to be designed,’ he says.

Increasingly, people want to work for businesses that have a really strong offer when it comes to sustainability, net zero and diversity

Sustainability services are the ‘fastest-growing part’ of Cundall’s business, according to Neeson, who says: ‘We’re ramping up rapidly there.’

Lewis agrees. ‘Anything related to sustainability is a hot market still. In the past two to three months, we probably had our strongest hiring months in the building engineering business on record.’

Ben Styles, Hays

This strong recruitment partly reflects how the market has cooled compared with this time last year, when a lot of staff were moving, increasing the pool of available people. ‘That’s coincided with a steady drop in attrition throughout the year. We’re in a very good place on both the hiring and the attrition side at the moment,’ says Lewis.

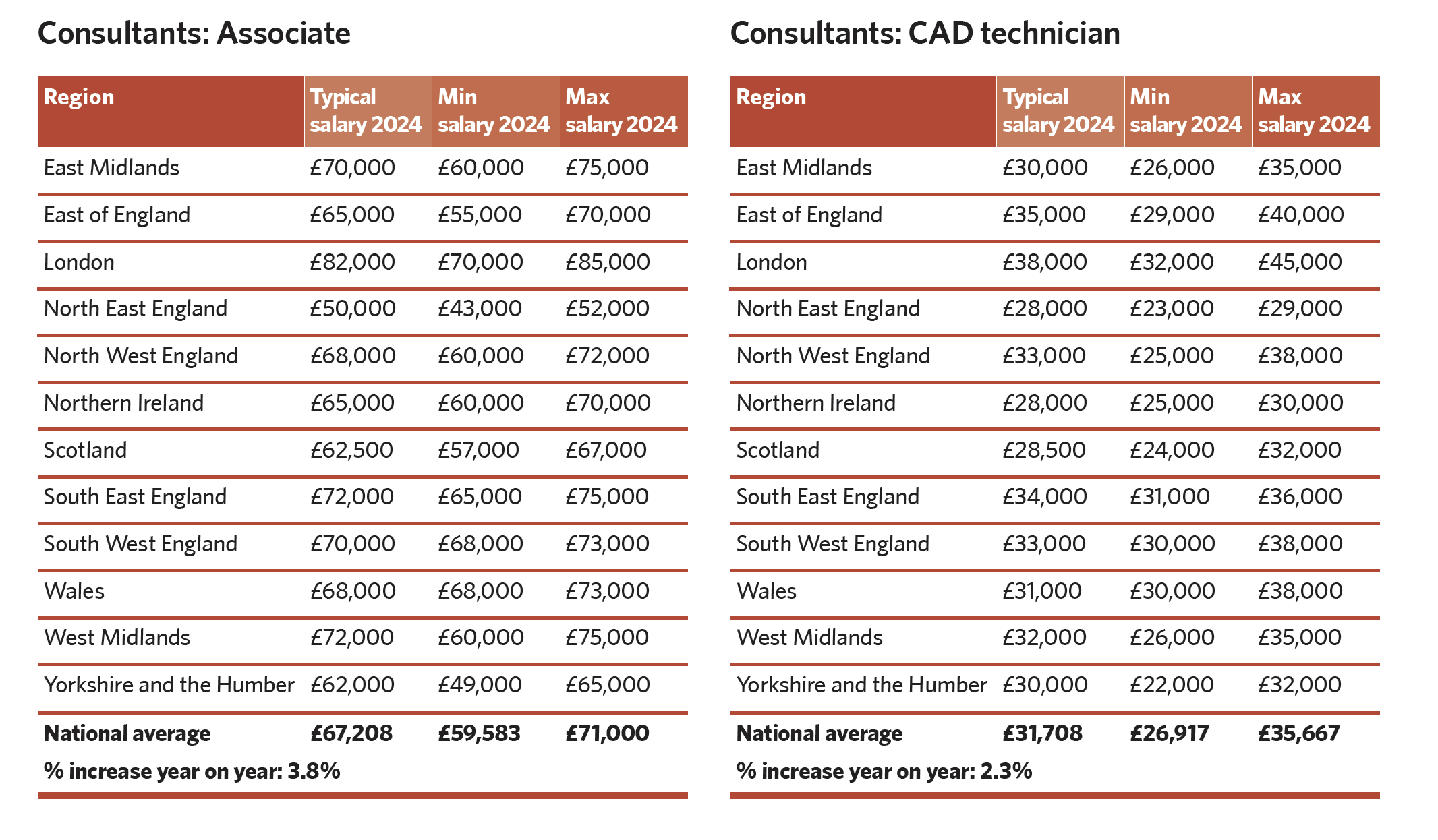

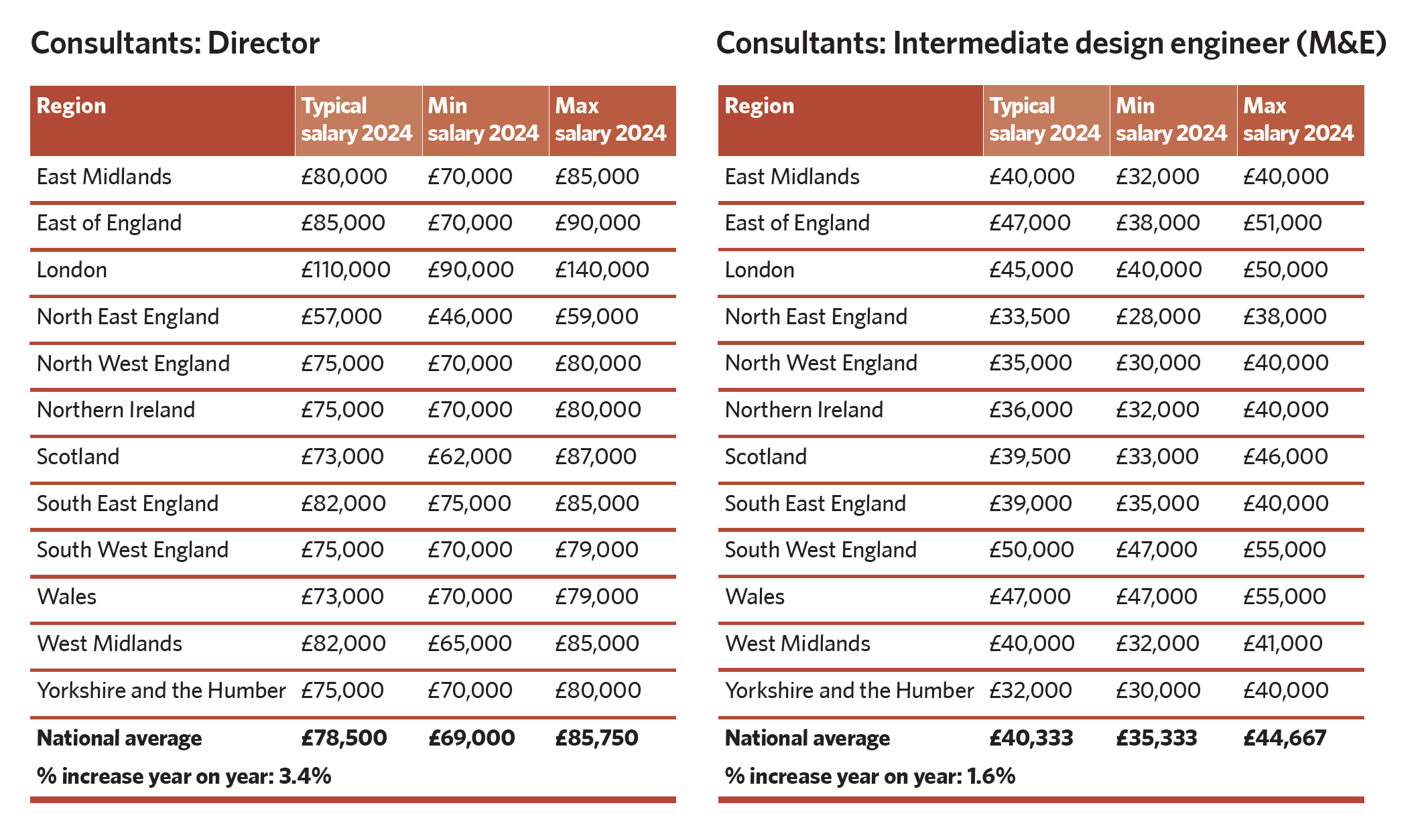

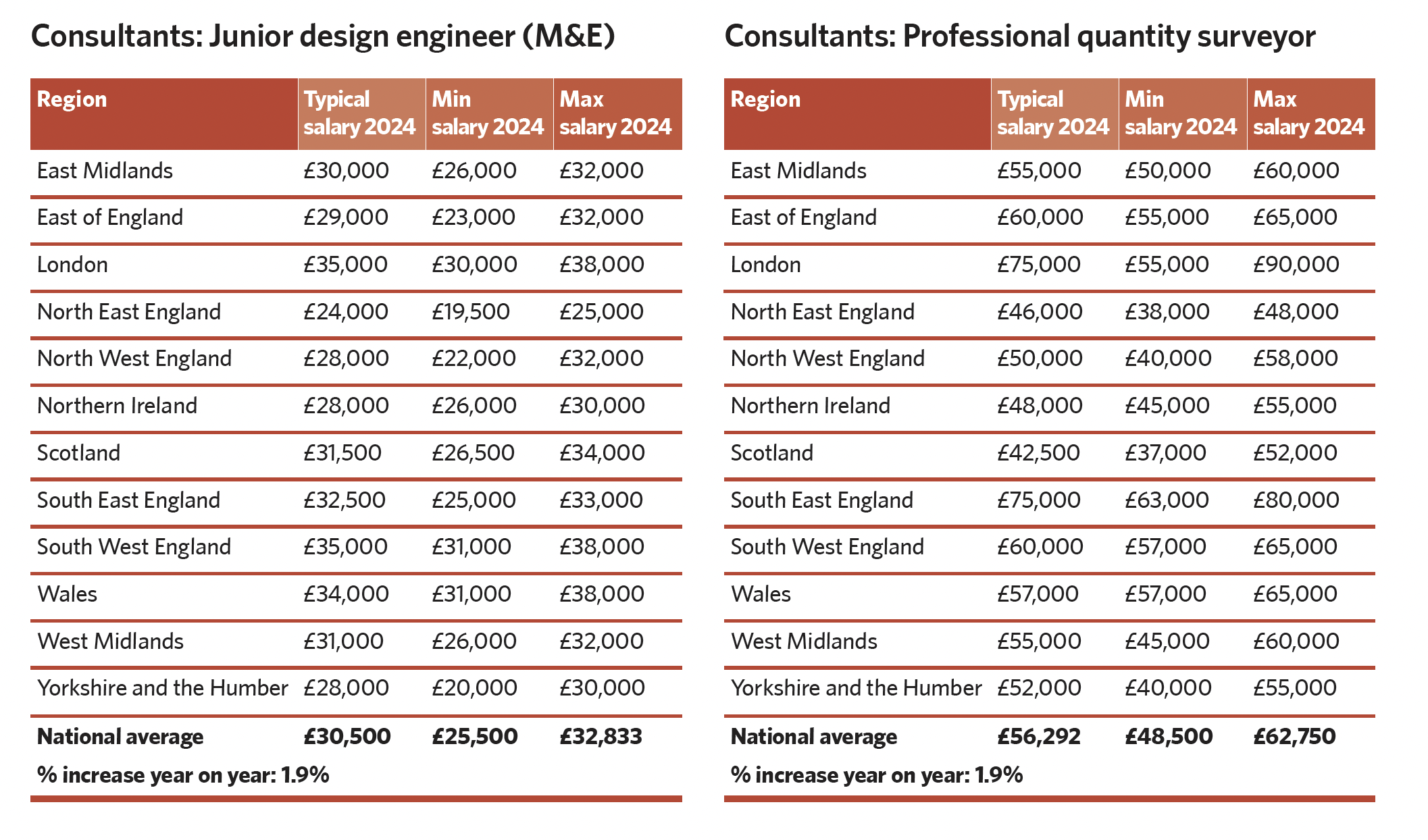

This slight cooling in labour-market churn perhaps explains why the level of salary increases reported in this year’s survey is lower than 12 months ago.

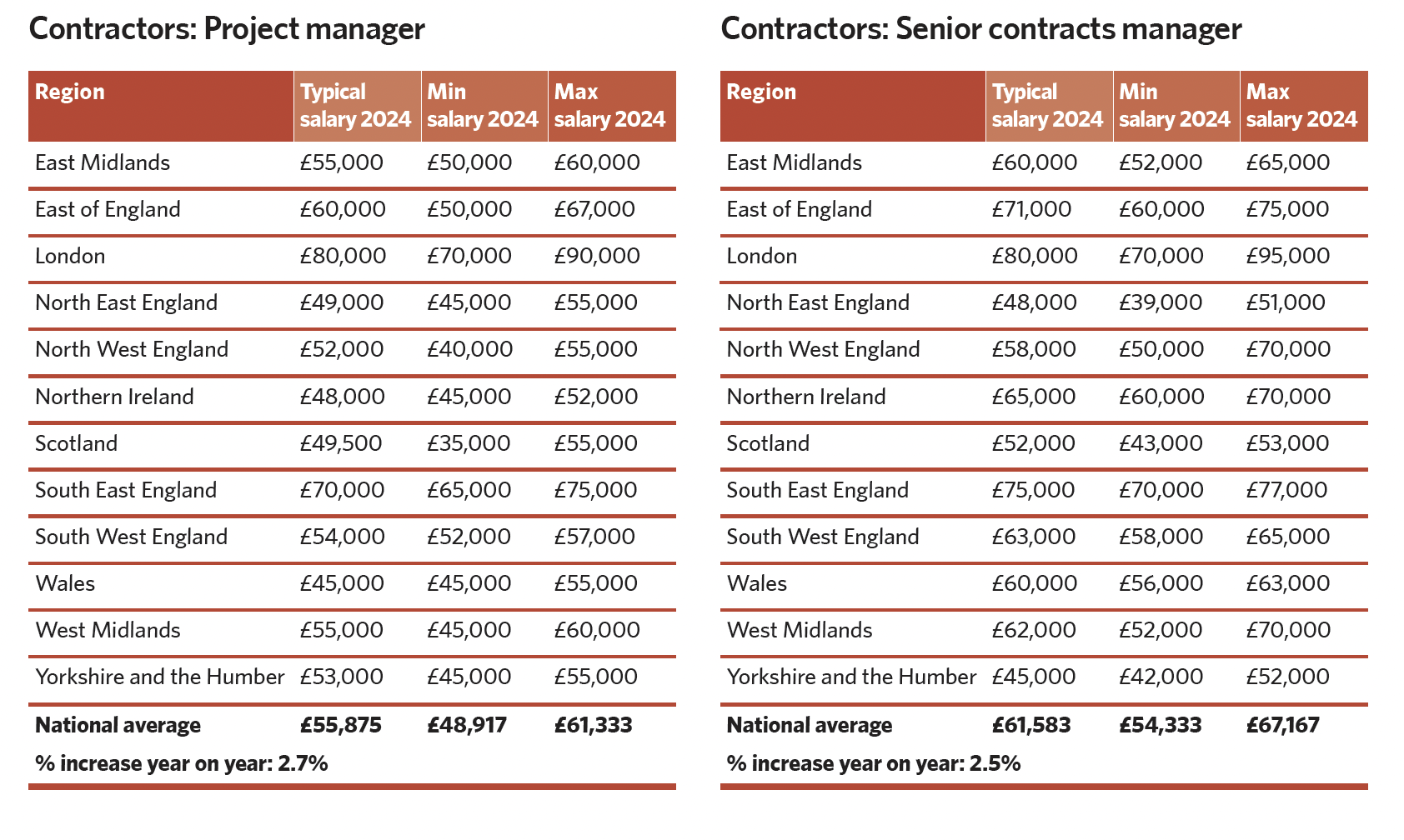

Overall, construction and property saw a 2.9% average salary increase over the past year, compared with 4.4% in 2022. The drop was even sharper for building services engineers: 2.5% compared with 5%. Nevertheless, the overwhelming majority (81%) of construction and property employers increased salaries for their staff in 2023, the same percentage that did so in the previous year, according to Hays.

Cundall awarded an average pay rise last year of 7%. ‘Our pay rises were really good because a key thing for us is making sure that we’re buying best in class,’ Neeson says.

Thomas Neeson, Cundall

Just more than a quarter (26%) of building services engineers say they have received a specific cost-of-living payment over the past 12 months. Cundall, however, chose instead to increase salaries, says Neeson: ‘We’ve put it on salary, not cost of living, because people benefit from it in the long term, rather than just a one-off payment.’

While Whitecode awarded a 5% increase, employees’ expectations have tempered, says Hill: ‘Across the company, we haven’t seen a massive jump in what people are demanding. If you’re good, you can walk out of a job in this industry and walk in anywhere you want. The difference is, those people who are not that good are not quite as demanding.’

Greater caution on pay is being seen more broadly across the industry, says Jackson: ‘Although there’s still a huge demand for people, companies are having to watch the pennies. They’re not necessarily prepared to break the bank like they were a year or 18 months ago – maybe because there’s not as much margin in projects and they are a bit worried about the future.’

This has driven a ‘more sensible approach’ to salary negotiations than last year, when five-figure increases were being dished out to some individuals, he says: ‘We’re not seeing as much of that now.’

Increasingly, companies are finding ways of holding onto staff that don’t involve hefty salary increase, says Styles. ‘We have seen a number of companies being a bit more flexible with certain things to make up for the salary,’ he says.

‘If you’re working from home, you don’t need to travel as much and you save a bit of money from not going in [to work]. A lot of clients have managed to keep hold of their staff by offering that flexibility, which is a lot better than having to offer big pay rises.’

Whitecode‘s ‘very flexible’ approach to allowing people to work from home as and when they need to makes good business sense, says Hill. A competitor company that blocked working from home, even during Covid, has paid the price in terms of staff losses, he adds: ‘It’s counted against them quite dramatically.’

Meanwhile, what engineers want from their roles is changing. Job security was rated by building services engineers as the most important factor, aside from salary, when considering a new role in last year’s Hays survey. That figure has now dropped to 15%. Rated as more important this year were a challenging role or projects, cited by 26%, followed by career development and CPD (20%). This possibly reflects a lower level of nervousness about job security than last year, when the shock of the Covid-19 pandemic was longer, says Styles.

John Lewis, Aecom

An organisation’s purpose, meanwhile, is important to 84% of building services engineers when considering a new role.

‘Working with an organisation with a green agenda, a good work-life balance and social purpose is important for everybody, but maybe particularly for building services engineers,’ says Styles.

‘Increasingly, people want to work for businesses that have a really strong offer when it comes to sustainability, net zero and diversity.’

Lewis agrees: ‘It’s more and more important for people that they believe the organisation has principles.’

Building services engineering is ‘ahead of some other parts of the industry’ on this score, says Style. ‘It’s quite an attractive sector to get involved in, with some really good environmental stuff,’ he adds.

Perhaps this sense of purpose helps to explain why 68% of building services engineers reported being positive about their career prospects in this year’s survey, up from 63% last year.

‘It’s a great place to be,’ says Lewis. ‘There’s a lot going on and building services are absolutely key to the whole net zero drive. Generally speaking, it’s a good time to be a building services engineer.