Building services salaries rose on average by 3.5%, compared with 3% for the industry as a whole, according to the 2026 Hays Salary Survey. This was a substantial increase on last year’s pay increase in building services, which was a minimal 1.3%. The overall UK average pay increase across all sectors is 2.2%.

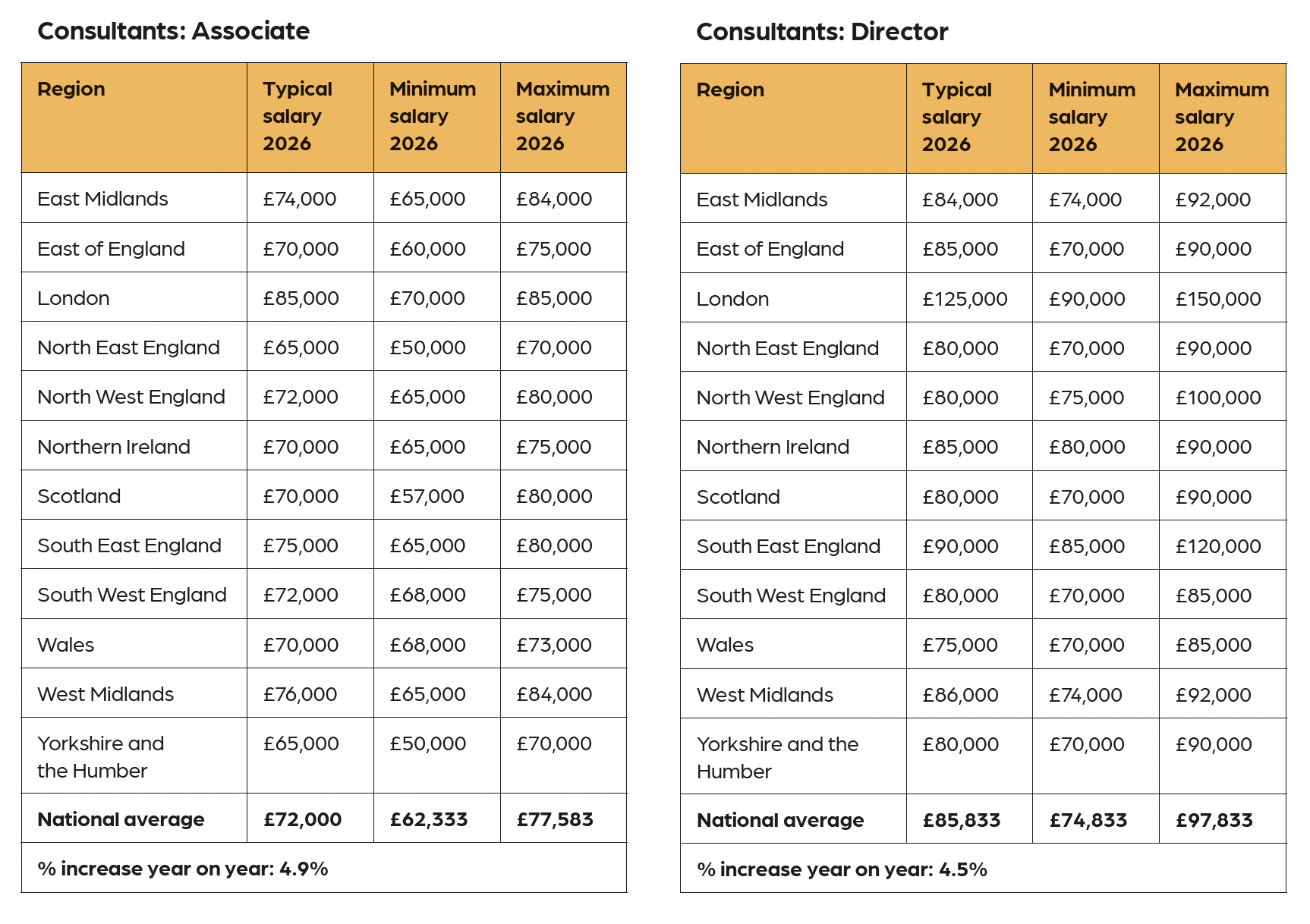

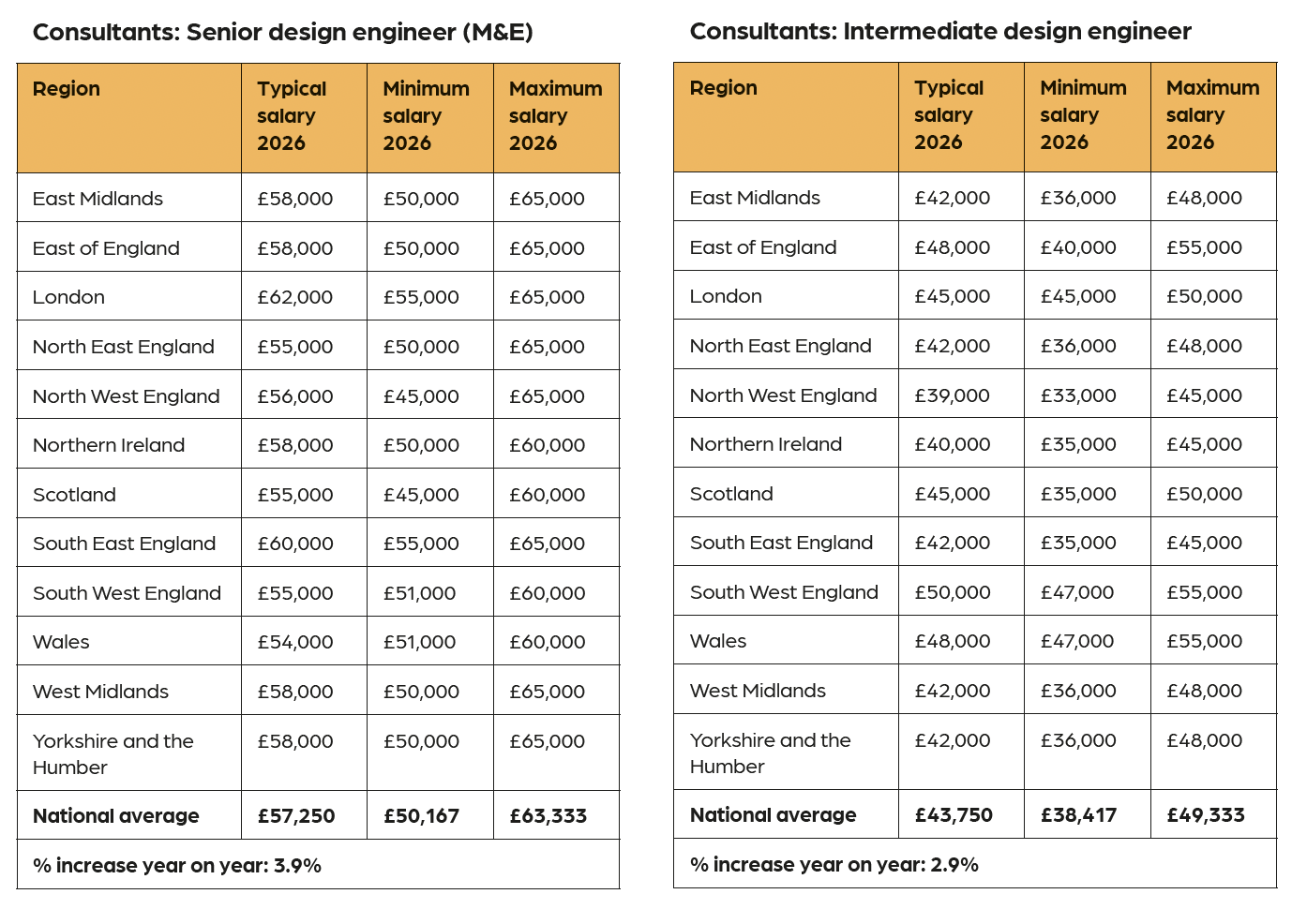

Consultants are leading the charge, with pay increases of 4.9% and 4.5% for associates and directors respectively. M&E quantity surveyors benefited from a 4.9% increase, while senior design engineers enjoyed a 3.9% rise.

Phil Jackson, national director at Hays, observes: ‘While we have seen signs of struggle in the overall construction industry, demand for people in building services is probably the strongest it’s been.’

For professionals in the sector, this confidence is strengthened by long-term drivers such as retrofit, performance optimisation and net zero delivery, adds Jackson.

However, the same forces sustaining demand are also exposing challenges around acute skills shortages, career progression and retention that the industry must now confront, he says.

Craig Watts, Hays’ national building services lead, believes the resilience in the building services discipline lies in its breadth and relevance. ‘Building services affects almost every aspect of modern life. It’s not as exposed to economic cycles because it’s not solely reliant on commercial development,’ he says, seeing this as a structural shift rather than a temporary trend.’

Mike Burton FCIBSE, environmental building engineering director at Aecom, echoes this longer-term perspective. ‘Change is constant and the market is challenging in places,’ he says, ‘but we have a shortage of housing, ageing estates and a clear need to decarbonise. Data centres, logistics, defence and aviation are all growing markets, and they need high-calibre engineers to support them. It’s a fantastic industry, with a huge positive impact on society.’

‘Data centres are a hotspot,’ Jackson agrees. ‘With MEP services accounting for roughly 60% of data centre construction costs, competition for specialised engineers in this sector is a major driver of the salary increases.’

Acute skills shortage

This sustained demand continues to collide with a constrained talent pipeline. According to the Hays guide, 92% of organisations experienced skills shortages in the past year, only a marginal improvement on the previous year and still the defining challenge shaping recruitment decisions.

Watts highlights electrical design engineering as an example of an acute pressure point. ‘Our demand for electrical design engineers is phenomenal,’ says Watts. ‘But the gap between supply and demand on the electrical side is more pronounced than in mechanical.’

Watts sees this pressure clearly in day-to-day recruitment activity. ‘In the past six months alone we’ve seen a 50% increase in demand – showing just how strong the market is, and how urgently firms are competing for talent.’

Digital-capability shortages are another factor compounding the issue, with only 27% of employers confident they have the right artificial intelligence (AI) capabilities, while half (50%) report moderate or severe shortages.

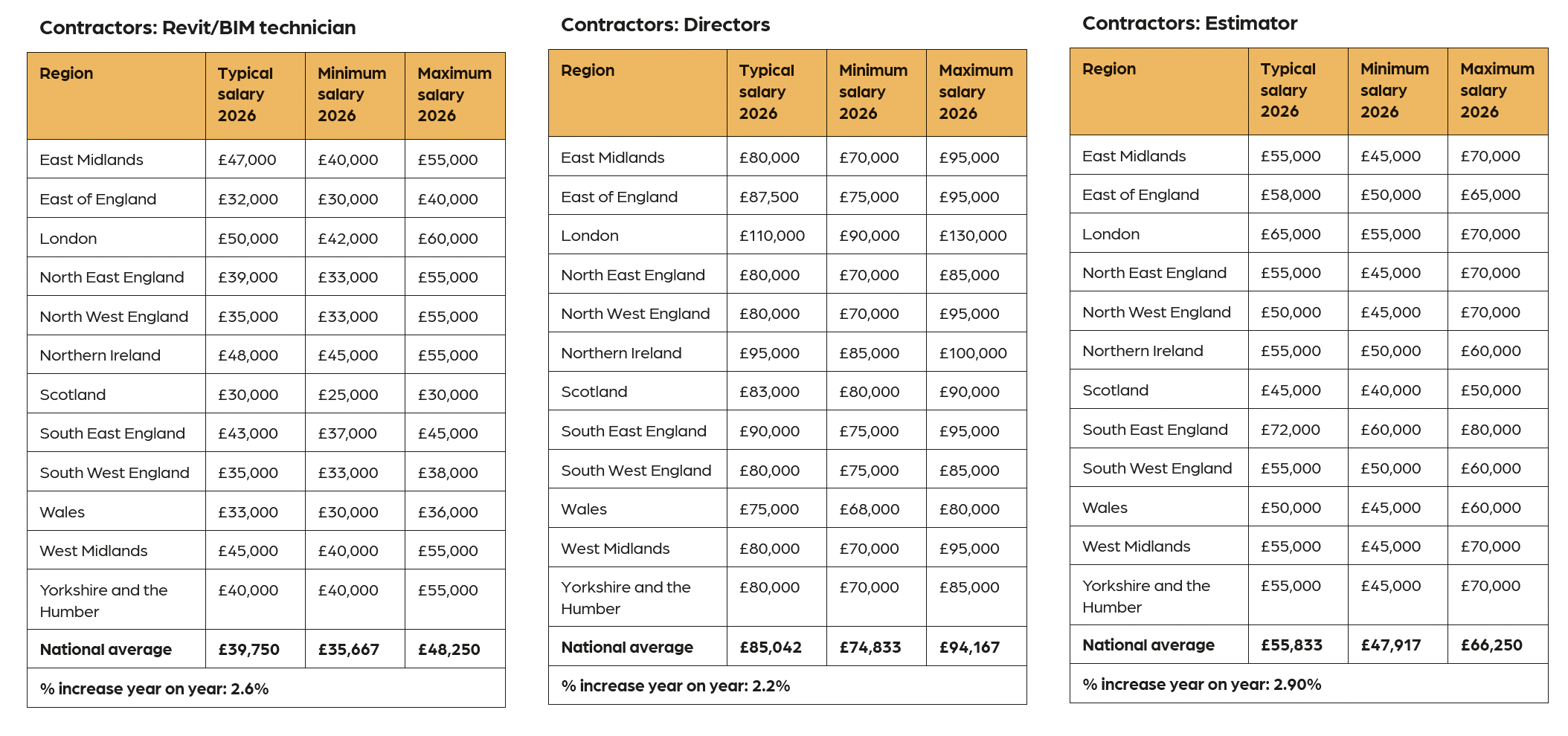

Revit has emerged as a clear hiring hotspot, shifting from a desirable skill to an essential one. Watts notes that Revit requirements are now frequent and increasingly senior. ‘We’re seeing employers move away from junior Revit users towards engineers with a high level of understanding of how these tools integrate with AI-driven generative design and digital twins. AutoCAD alone isn’t enough any more. Engineers need to upskill and move with the industry.’

In response, employers are moving toward more holistic hiring. ‘We value technical curiosity and adaptability over fixed skillsets, prioritising openness to learn, critical thinking and problem-solving,’ says Andy Grint, learning and development coordinator at Hilson Moran. This reflects a wider industry shift where 73% of firms now prioritise attitude over existing skills.

The definition of senior competence is also evolving. While technical capability remains a baseline requirement, soft skills are now a primary differentiator for progression and access to the highest salary bands.

‘Commercial awareness has definitely gone up the ranking in terms of what clients are asking for,’ says Watts. Communication, client engagement and leadership are increasingly critical, particularly as firms manage complex change around technology, flexible working and workload pressures.

Pay has responded to these pressures, though increases remain measured. Over the past 12 months, 85% of employers increased salaries, most commonly by 2.5-5%.

Looking ahead, 84% of employers expect to raise salaries again. Jackson notes that building services is experiencing some of the strongest upward pressure. ‘Electrical skills shortages, retrofit, net zero and cost-of-living considerations are all converging. Many employers are actively reviewing pay structures to retain existing staff.’

Salary alone is no longer sufficient to retain experienced engineers. At Hilson Moran, ‘wellbeing and social value are core to how we operate – from flexible working to open conversations around mental health,’ says Grint. ‘Creating an environment where people feel supported, heard and able to grow is fundamental.’ Successful employers are increasingly making these principles a core business objective.

Employers should also be wary of the 64% of professionals who intend to look for a new role within the next 12 months. Watts says a lack of flexibility and opportunity in a role can be a major cause of dissatisfaction. ‘It is vital that employers clearly articulate and signpost opportunities for progression, or they risk losing talent simply because the route forward wasn’t communicated strongly enough,’ adds Watts.

At Aecom, graduates and apprentices rotate across disciplines, and receive structured training in technical and soft skills. ‘Career planning, variety and learning are key to retaining talent,’ Burton says.’

For Burton, long-term resilience depends on broadening awareness and investing in people. ‘We need to raise awareness of the industry and its specialisms,’ he says. ‘Areas such as building physics, CFD, fire and façade engineering are difficult to recruit for, simply because people don’t know these career paths exist.’